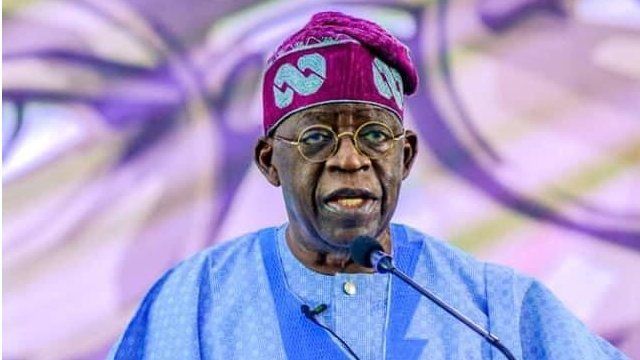

President Bola Tinubu has asked the National Assembly to approve fresh N1.767trn external borrowing plan in support of the 2024 Budget.

The president conveyed his request in a letter written to Senate President Godswill Akpabio and Speaker of the House of Representatives, Tajudeen Abbas.

The presiding officers read the letter during plenary, on Tuesday.

The president said if approved, the loan would be used to partly finance the N9.7trn deficit in the 2024 budget.

He said his request, which has been approved by the Federal Executive Council (FEC), aligns with Section 21(1) and 27(1) of the Debt Management Office Act.

Tinubu has also forwarded the Medium Term Expenditure Framework and Fiscal Strategy Paper (MTEF/FSP) 2025-2027 to the National Assembly and the National Social Investment Programme Establishment Amendment Bill, to make the social register the primary tool for the implementation of the federal government’s social welfare programmes.

The Federal Government had approved a $2.2billion external borrowing plan last week.

The president’s letter outlined three potential financing options to raise the required funds which include issuance of Eurobonds, Sovereign Sukuk and Bridge Finance/Syndicated Loans.

On Eurobonds, he said Nigeria could raise all or part of the funds through Eurobond sales in the International Capital Market (ICM).

President Tinubu noted that the ICM remains accessible to countries like Nigeria, citing recent issuances by Côte d’Ivoire, Kenya, and Cameroon in 2024.

On Sovereign Sukuk, the president said the debut issuance of Sovereign Sukuk worth $500 million is being considered, with credit enhancement from the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), a member of the Islamic Development Bank Group.

Equally, the President said the Bridge Finance/Syndicated Loans option involves loans from international financial institutions such as Citigroup, Goldman Sachs, and JPMorgan, should Eurobond issuance face delays due to market conditions.

He said the government plans to pursue these options simultaneously, prioritising Eurobond issuance for its relative speed and cost-effectiveness.

Utilization of Funds

On the utilisation of the funds, the president said it will support key projects in priority sectors, including power, transport, agriculture, and defense.

He said the proceeds will also bolster external reserves through deposit into the Central Bank of Nigeria’s account, thereby stabilising the Naira.