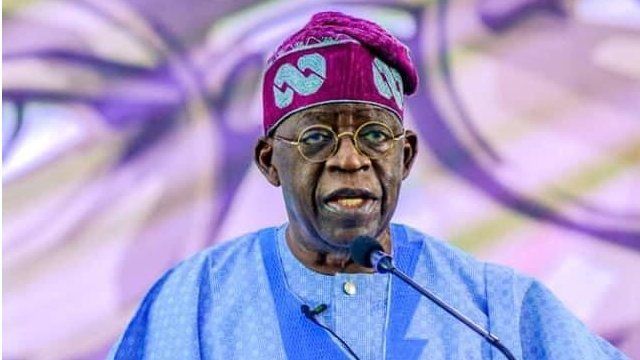

The Nigerian government, led by President Bola Tinubu, has declined a recommendation from the National Economic Council (NEC) and Northern governors to withdraw the tax reform bills currently under consideration in the National Assembly.

This decision was conveyed in a statement on Friday by Bayo Onanuga, Special Adviser to the President on Information and Strategy.3According to the statement, President Tinubu acknowledged NEC’s suggestion, led by Vice President Kashim Shettima and supported by the 36 state governors, to reconsider the reforms.

However, he emphasized that the legislative process itself provides an opportunity for amendments without withdrawing the bills entirely.

“The legislative process, which has already begun, allows for inputs and necessary changes without withdrawing the bills from the National Assembly,” he noted.

The tax reform bills, aimed at restructuring Nigeria’s tax system, have sparked debate, particularly in Northern Nigeria.7Northern governors recently voiced their opposition to aspects of the reforms, such as the proposal to share Value Added Tax (VAT) revenue on a derivation basis, expressing concerns over its potential impact on states’ revenue.

Despite these objections, the presidency stated that Tinubu remains open to further consultations as the National Assembly reviews the bills.9“President Tinubu welcomes further consultations with key stakeholders to address any reservations about the bills while the National Assembly considers them for passage,” Onanuga’s statement read.

The proposed tax reforms follow Tinubu’s establishment of the Presidential Committee on Tax and Fiscal Policy Reform in August 2023, aimed at improving Nigeria’s tax environment.

The committee, which has been in operation for over a year, incorporated feedback from various stakeholders, including professional associations, trade groups, government agencies, and the private sector.

Among the provisions of the reform bills is the elimination of multiple taxation and the streamlining of tax obligations to enhance business operations in Nigeria.

The proposed Nigeria Tax Administration Bill seeks to harmonize tax processes across federal, state, and local levels to boost compliance and increase revenue generation.

Additionally, the reforms propose restructuring the Federal Inland Revenue Service (FIRS) into the Nigeria Revenue Service (NRS) to expand its mandate for national revenue collection.

A new Joint Revenue Board would replace the existing Joint Tax Board, consolidating tax authorities across all government levels, and an Office of the Tax Ombudsman would be established to address taxpayer concerns and disputes.

“While there may be differences in approach or specific provisions of the new tax bills, what is agreed upon is the need to review our tax laws and how they are administered to support national development,” the statement concluded.