The National Hajj Commission of Nigeria (NAHCON), on Thursday signed an agreement with the Jaiz Bank Plc, for a Hajj Savings Scheme in the country.

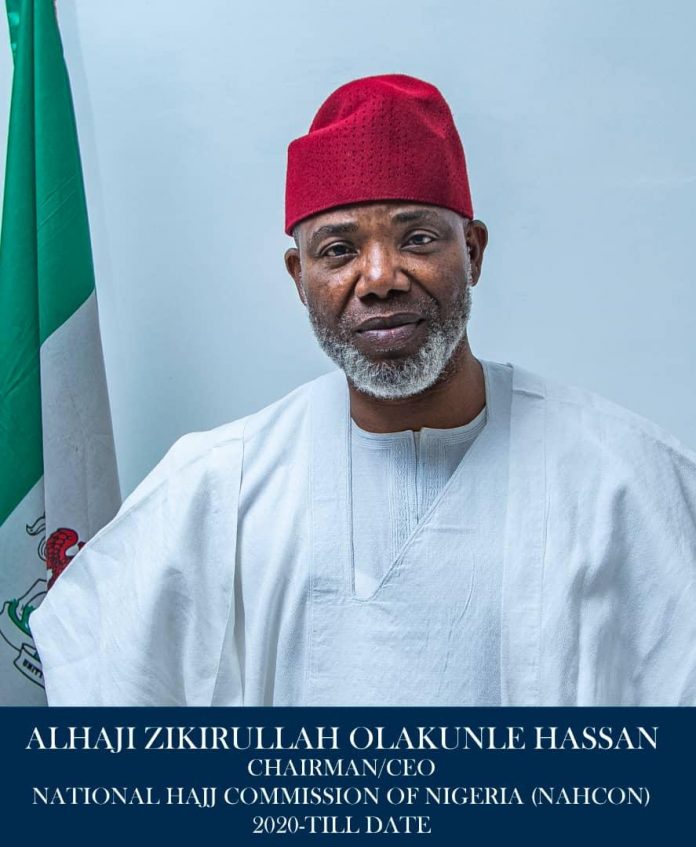

NAHCON Executive Chairman, Alhaji Zikrullahi Hassan, said this while signing the agreement designed to fast-track the implementation of the scheme.

Hassan explained that scheme was enshrined in NAHCON Establishment Act, 2006 as a contributory payment scheme for prospective Muslim faithful wishing to undertake Holy Pilgrimage to Saudi Arabia.

He said that the agreement was a step towards securing the Central Bank of Nigeria (CBN)’s license for the operation of the scheme as a full fledged model.

He said that the scheme was expected to boost economic growth, entrench culture of savings among low income groups and lift people out of poverty.

He said every Muslim faithful, who intended to perform the Hajj could be enroled in the scheme through the Pilgrims’ Welfare Board in all the 36 states, agencies and commissions or NAHCON offices across the country.

“Enrolment can also be done directly from the comfort of room by logging into the dedicated site of the scheme.

“Subscribers can also deposit at their convenience, and the amount they want to contribute over a specific period to be determined by them.

“Deposits made will be invested in low risk Sharia-compliant product which will be monitor by the commission and profit share among stakeholders.

“In line with the provision of NAHCON ACT, 2006 and in consultation with the board, we shall in due course constitute a Board of Trustees to be submitted to the government,’’ Hassan said.

Mr Boss Mustapha, Secretary to the Government of the Federation (SGF), advised the Muslim faithful to imbibe the saving culture and long-term planning in order to key into the Hajj family.

Represented by Mr Olusegun Adekunle, Permanent Secretary, General Service, Office of the SGF, Mustapha urged the board and management of NAHCON to secure the license from the CBN in order to deploy the full-fledged scheme under a Special Purpose Vehicle.

He noted that promoting national cohesion and social inclusion was one of the core principles upon which the present administration’s Economic Growth Recovery Plan (ERGP) was built.

The SGF said that government encourage programmes that have positive socio-economic impact on Nigerians and that the Hajj savings scheme was one of such.

“The success of similar schemes in some countries gives us the hope that Nigeria by virtue of its population, constituting one of the largest Hajj contingents will succeed in this endeavour and usher in a new era in the history of Hajj management to meet and possibly surpass the best in the world today.

“It is my sincere hope that all stakeholders in this scheme will give their all so that Nigeria will not only have a scheme which we can be proud of, but one that others will learn from,’’ he said.

The Chairman Board of Trustees, Jaiz Bank, Alhaji Umar Mutallab, said that the bank was committed to the success of the scheme.

NAN